Job Market Paper

Consumer Debt Moratoria

(with Bulent Guler, Yasin Kürsat Önder, and Mauricio Villamizar)

Working Paper Slides

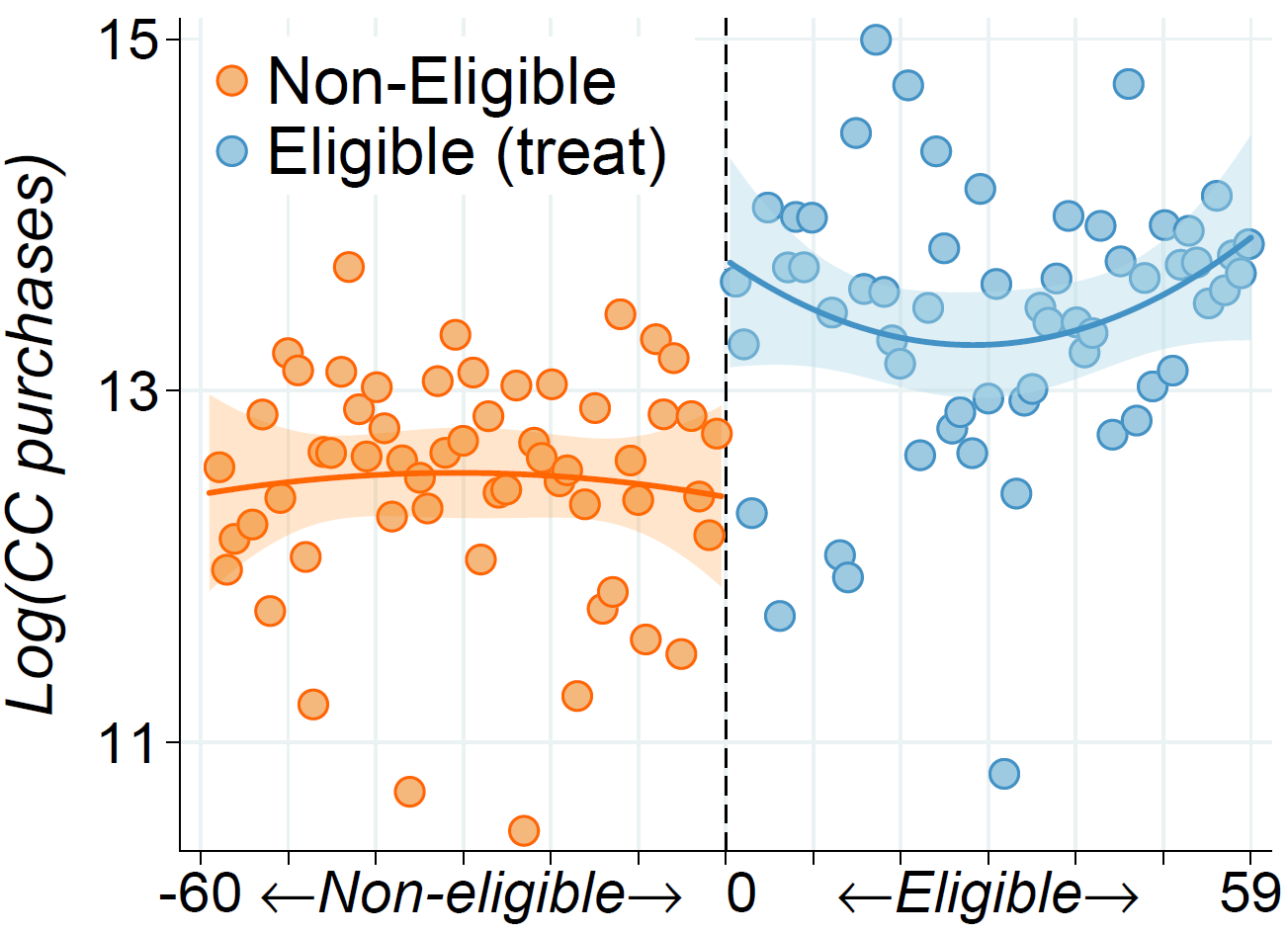

We evaluate the effectiveness of consumer debt moratoria. Using administrative data from Colombia, our study compares households that narrowly qualified for the moratorium against those who narrowly missed eligibility. Our analysis indicates that the moratorium policy boosts consumption among financially strained households while reducing delinquency rates on mortgages and other loans. We then develop a life-cycle incomplete market model to examine the effects of the policy. Our model shows that the policy increases consumption, and welfare for all agents, and facilitates financial stability by attenuating the decline in house prices. Finally, we use our model to explore alternative policies.

Working Papers

Debt Moratoria and Macroeconomics

(with Yasin Kürsat Önder, and Mauricio Villamizar)

Working Paper Slides

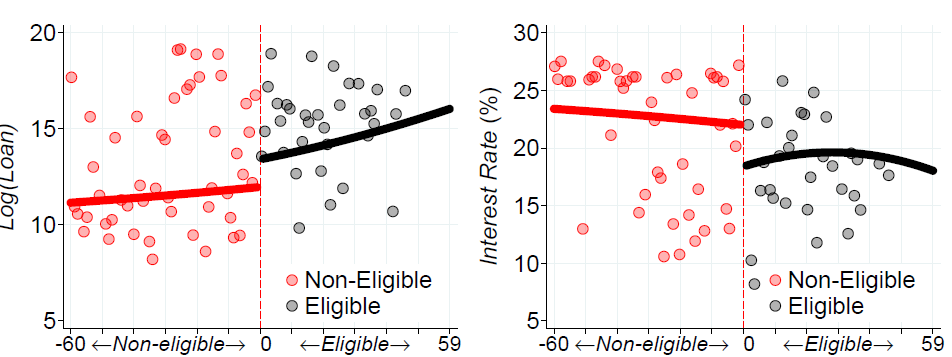

Our study analyzes the impact of debt moratorium policies, possibly the oldest approach to addressing repayment problems. Using Colombian administrative data, we compare two groups of firms: those narrowly meeting moratorium criteria and those missing it. Our findings show that stressed firms accessing moratoria enjoy favorable loan conditions on subsequent borrowing: higher loan amounts, a higher probability of obtaining a new loan, and lower interest rates, which in turn drive increased investment and employment. We propose a quantitative general equilibrium model to assess short- and long-term implications, and find reduced liquidity concerns alongside heightened default risk. Importantly, our research underscores welfare benefits of interest forgiveness during debt suspension.

Credit Guarantees, Firm Response, and Macroeconomics

(with Yasin Kürsat Önder)

Working Paper Slides

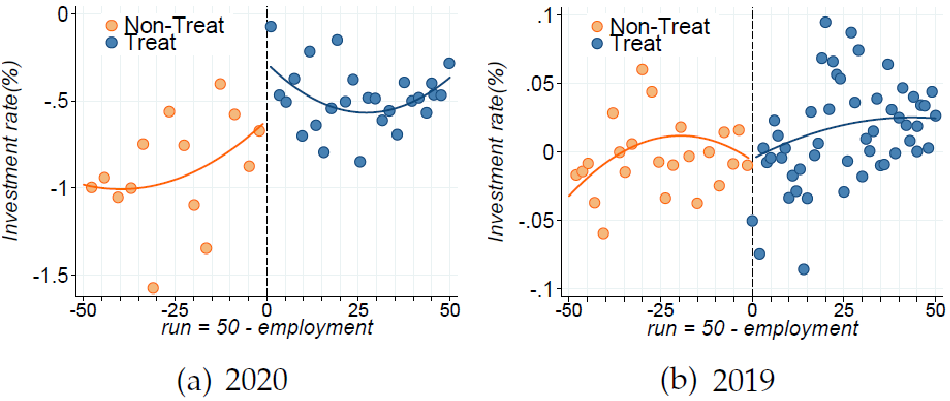

We evaluate the impact of Belgium's 2020 Public Credit Guarantee Scheme (CGS) using administrative data. The CGS applied to all firms, with those employing fewer than 50 workers benefiting from a 25 basis point reduction in interest rates. Leveraging this policy-induced discontinuity, we compare firms around the employment threshold. Firms receiving the lower interest rates experienced increases in employment and investment, along with a reduction in firm exit rates. The scheme helped address the debt overhang problem by easing price-related credit constraints: for every € 1 of guaranteed debt at a 25 basis points lower rate, non-guaranteed debt decreased by € 0.13.

Employment Fluctuations, Real Estate Prices and Property Taxes

Working Paper Online Appendix Slides

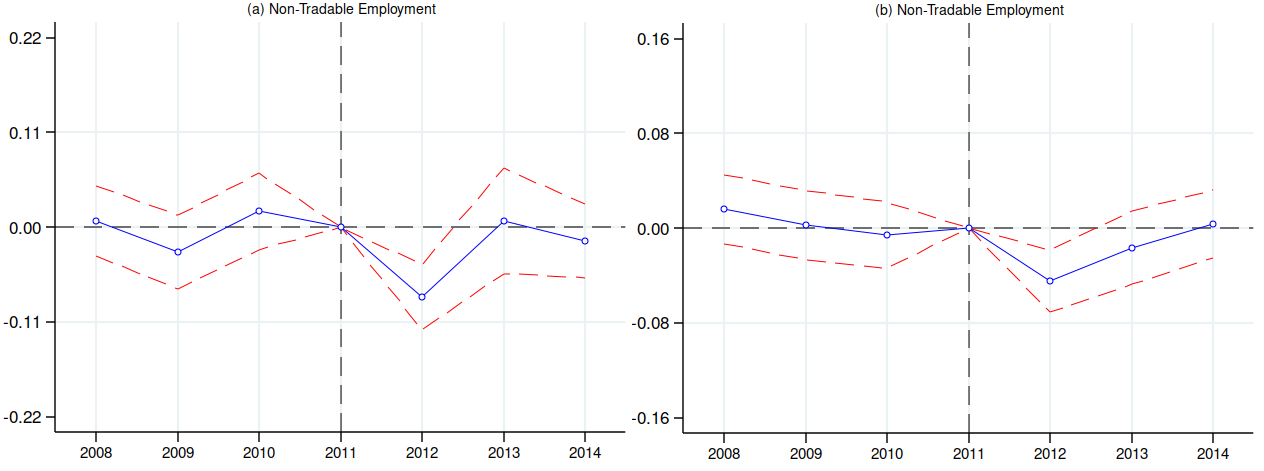

This paper studies the role of real estate prices on employment fluctuations. We focus on the relative importance of the housing wealth and firm collateral channel on employment. We use empirical evidence from Italian municipality data and feature a quantitative model with financial frictions to quantify each channel. First, we exploit municipal-level variation in property tax changes to estimate its effect on labor, consumption, and real estate prices during Italy’s 2012 property tax reform. Then, we use the estimates to calibrate a quantitative model that includes houses and commercial real estate charged with different property tax rates. We find that both channels explain more than 50% of the employment decline due to higher property taxes. However, the firm collateral channel reduces employment by 20% more than the housing wealth channel.

Investment, Capital Structure and Default Risk

Working Paper

This paper studies how a firm’s capital structure shapes the investment response during a sovereign debt crisis. To estimate the heterogeneous effect of capital structure on investment response to default risk, we use balance-sheet data for Italian firms during 2007-2015. We find that changes in default risk produce a negative response to investment, which changes with the capital structure. Specifically, the negative response of investment is amplified by at least 55% with higher leverage. However, investment sensitivity could be heightened or attenuated by about 15% with higher maturity, depending on whether firms are highly indebted. We build a partial equilibrium model of investment, short-term and long-term debt, and limited commitment to understanding the mechanisms that explain our empirical results. Our model shows that the effect of debt overhang, rollover risk and its interaction can qualitatively capture the empirical results obtained with Italian data for firms.

Work in Progress

Labor Market Frictions, Employment Costs, and Sovereign Default Risk

Click for Abstract

This paper studies the employment consequences during a period characterized by a sharp increase in the spread of sovereign government bonds. In particular, we want to understand how the employment response can allow us to understand the output costs after sovereign default. First, we provide empirical evidence of the labor market response along three dimensions: employment growth, hiring rates, and laid-off rates using detailed employee-employer data for Brazil from 2013-2016. Next, we use the empirical results to discipline a quantitative model of sovereign default with financial and labor market frictions. The calibrated model is then used to quantify the importance of the employment drop during a default episode to explain the output costs of default.